Global political science risks have soared since Russia invaded the state. Investors, market participants, and policymakers expect that the war can exert a problem on the world economy while pushing up inflation, with a pointy increase in uncertainty and risks of severe adverse outcomes.2 As an example of those concerns, the Apr 2022 edition of the International Financial Fund's World Economic Outlook contains quite two hundred mentions of the word "war." Some economic effects are already materializing. The economies of Russia and Ukraine are acquiring sharply as an instantaneous result of the war and therefore the sanctions are obligatory on Russia. artifact markets are in turmoil ANd money markets are extremely volatile since the beginning of the conflict. In light-weight of those developments, a key question is: what proportion can political science tensions weigh down economic activity in 2022 and beyond?

during this note, to answer this question, we tend to initially quantify the recent rise in geopolitical risks victimization 2 measures supported matter analysis: one specializing in newspaper articles, and another created from transcripts of firms' earnings calls. Armed with these numerical measures, we use an economic science model and up-to-date knowledge to supply empirical proof of the world economic science effects of movements in political science risk.

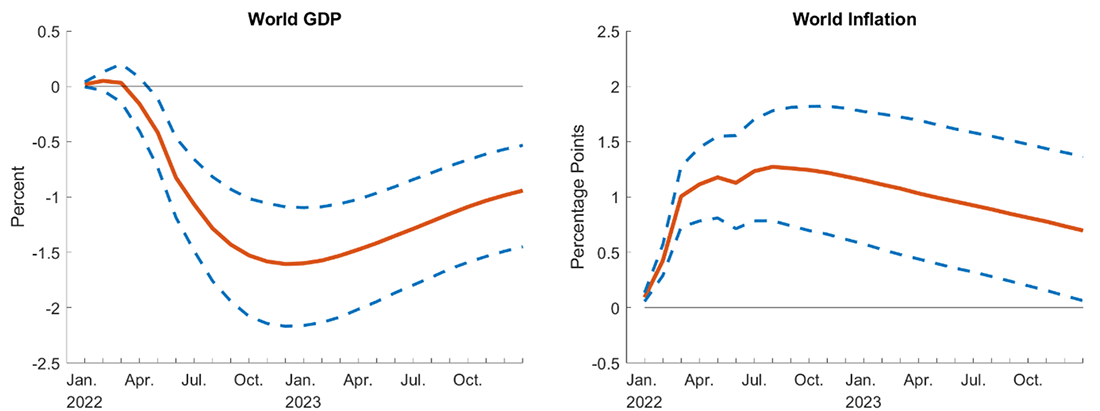

Our main result recommends that the increase in geopolitical risks seen since the Russian invasion of state can have non-negligible economic science effects in 2022. Relative to a no-war counterfactual, the model sees the war as reducing the amount of world value by regarding 1.5 p.c and resulting in an increase in global inflation of about 1.3 proportion points. The adverse effects of geopolitical risks within the model operate through lower shopper sentiment, higher artifact prices, and tighter money conditions. Additionally, firm-level indicators suggest that success for the ECU economies will doubtless be the greatest, particularly in goods-producing industries.

measuring of political science Risks

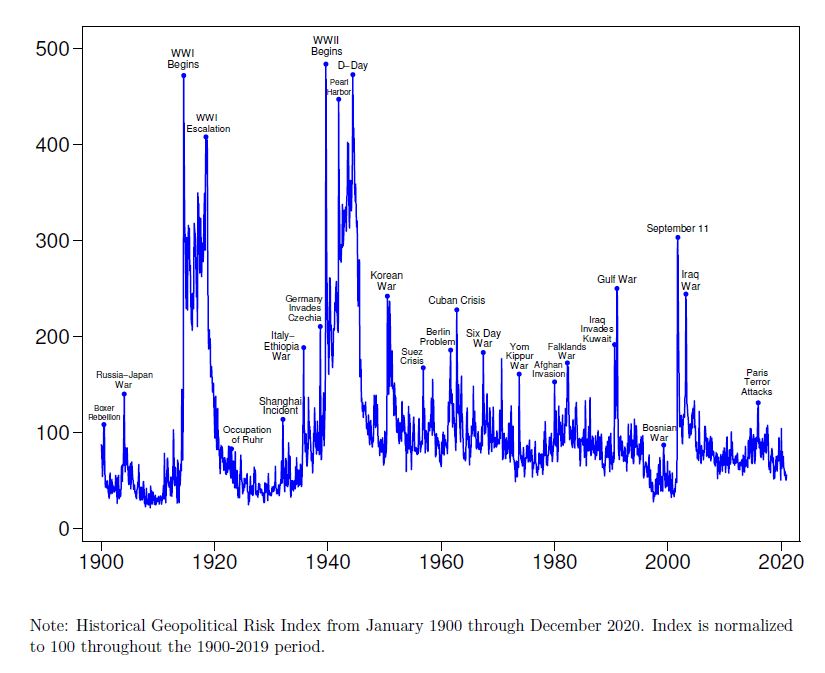

A key challenge to understanding and quantifying the results of heightened geopolitical tensions pertains to their measurement. Our initial measure is that the Caldara-Iacoviello geopolitical risk (GPR) index, created victimization searches of newspaper articles that mention adverse geopolitical events and associated risks. The GPR index tracks references to wars, terrorist attacks, and any tensions among states and political actors that have an effect on the course of international relations.3 The index starts in 1900 and relies on machine-controlled text searches of the Chicago Tribune, the big apple Times, the Washington Post, and, in recent years, seven extra newspapers from the U.S., U.K., and Canada. Figure one plots the GPR index since 1970: spikes within the index are related to wars, risks of war, and major terrorist events. Of note, the index spiked in the aftermath of the Russian invasion of Ukraine—in March 2022, readings of the index reached one of all the best values in the past fifty years, comparable similar peaks throughout the Gulf and Al-Iraq Wars.

The two building blocks of the general GPR index are the political science threats (GPT) index, which captures considerations regarding the scope, duration, and ramifications of geopolitical tensions and conflicts, additionally the} geopolitical acts (GPA) index, which captures events reminiscent of the beginning and the actual evolution of wars.4 As shown within the left panel of Figure 2, the GPT index, which surged between Jan and March, declined in a Gregorian calendar month and May, in step with the read that extreme outcomes of the war, such as the direct involvement of additional countries, are maybe perceived as less likely. The grade point average index also spiked in the aftermath of the invasion and is retracting, albeit additional slowly.

Recent Geopolitical Concerns

We complement data from the GPR index with a second, different live of government risks created by looking out the transcripts of the earnings decision of worldwide listed corporations for mentions of the Russian invasion of Ukraine.5 issues concerning the conflict are pervasive in earnings conference calls across the globe, with forty p.c of all earnings calls command in a Gregorian calendar month a pair of022 expressly mentioning the conflict. because the right panel of Figure 2 shows, that the geopolitical risk measure supported earnings calls shares terribly similar dynamics to the newspaper-based indexes, disposal support to the notion that the newspaper-based GPR indexes are capturing data that's relevant to corporations and investors.

Quantifying the results of upper government Risks on gross domestic product and Inflation

Historically, periods of elevated geopolitical risks are related to sizable negative effects on world economic activity.6 Wars destroy human and physical capital, shift resources to less economical uses, divert international trade and capital flows, and disrupt global offer chains. Additionally, dynamical perceptions concerning the variety of outcomes of adverse geopolitical events might sadden economic activity by delaying firms' investment and hiring, geologic process client confidence, and altering money conditions.

Our numerical measure of government risk permits the U.S.A. to quantify the results of its recent spike in world economic activity. to the current end, we tend to estimate a structural vector autoregression (VAR) model and use the calculable model to quantify the effects over time of the recent spike in geopolitical tensions. The model includes the monthly lives of world GDP, world inflation, global stock prices, real oil prices, the broad real dollar, artifact prices, global client confidence, and also the geopolitical threats (GPT) and geopolitical acts (GPA) indexes.7 The volt-ampere model uses information from Jan 1974 through the Gregorian calendar month 2022 and includes 3 lags.8 we tend to assume that changes within the GPT and standard indexes drive all within-month fluctuations in the opposite economic variables, so any contemporaneous correlation between government risks and money variables, say, is assumed to mirror the result of geopolitical risks on financial variables, instead of the other approach around. however, with a lag, every variable will have an effect on all variables.

Figure three uses a historical decomposition of the calculable volt-ampere results to simulate the results over time on world gross domestic product and inflation of the heightened geopolitical risks since Jan 2022. the increase in geopolitical risks discovered up to now this year produces a drag on world gross domestic product that builds throughout 2022, cumulating to a negative impact of around 1.7 p.c on the extent of world output. Similarly, the increase in government risks boosts prices, inflicting a rise in global inflation of 1.3 share points by the half of 2022, when the results begin to subside.

Effects of the Recent Increase in Geopolitical Risk

The geopolitical risk index.

How are political science risks transmitted to the worldwide economy? With numerous channels controlled for, the structural power unit estimates leave us well-positioned to answer this question. Figure four presents a lot of elaborate images of the manner the global economy responds to a geopolitical risk shock. the results of elevated geopolitical risks in 2022 are related to declining client confidence and stock costs, factors that weaken mixture demand. The exchange worth of the greenback appreciates, in line with the proof that spikes in global uncertainty and adverse risk sentiment will trigger flight-to-safety international capital flows (Forbes and Warnock, 2012). trade goods prices and oil costs increase, golf stroke downward pressure on world activity and upward inflation pressure.

Comments

Post a Comment

Thank you